Content

Each of these accounts is represented by a separate column in the statement. While the concepts discussed herein are intended to help business owners understand general accounting concepts, always speak with a CPA regarding your particular financial situation. The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status.

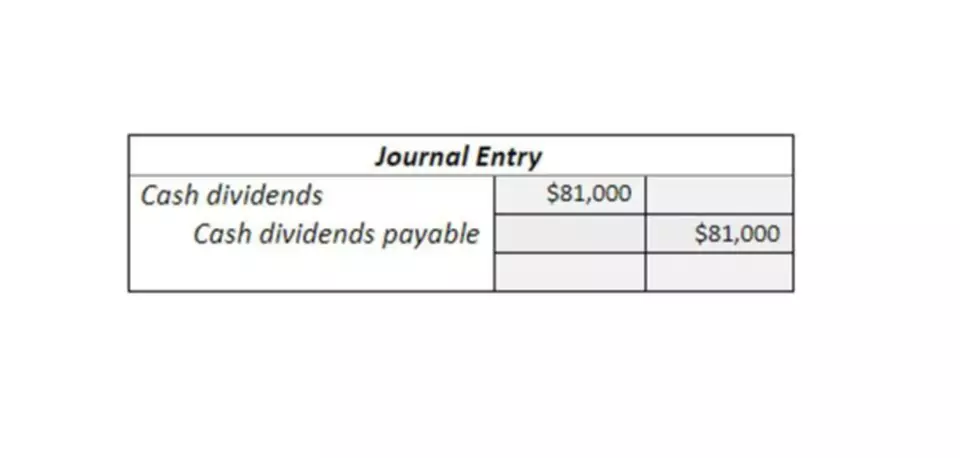

- Current period dividend payments or announcements must be deducted from shareholder equity as a distribution of wealth of stockholders.

- It can also reveal whether you have enough equity in the business to get through a downturn, such as the one resulting from the COVID-19 pandemic.

- In events of liquidation, equity holders are last in line behind debt holders to receive any payments.

A company’s statement of shareholders’ equity is a financial statement that shows the changes in a company’s equity during a reporting period. The statement of shareholders’ equity includes information about the company’s beginning shareholders’ equity, changes in shareholders’ equity during the reporting period, and the company’s ending shareholders’ equity. The statement of shareholders’ equity is important because it shows how a company’s equity has changed over time and can be used to help investors understand a company’s financial condition.

Statement of changes in equity

Shareholder’s equity is basically the difference between total assets and total liabilities. Note that the $95,000 appears as a negative amount because the outflow of cash for capital expenditures has an unfavorable or negative effect on the corporation’s cash balance. The $15,000 is a positive amount since the money received has a favorable effect on the corporation’s cash balance.

IAS 1 requires a business entity to present a separate statement of changes in equity as one of the components of financial statements. Therefore, the statement of retained earnings uses information from the income statement of stockholders equity statement and provides information to the balance sheet. Amount, after tax and reclassification adjustment, of decrease in accumulated other comprehensive income for defined benefit plan, attributable to parent.

How to Calculate Stockholders’ Equity

Other relatively less popular components are Treasury stock Capital reserve, Revaluation surplus, profit or loss from the sale of securities, and gains and losses on cash flow hedge. No headers Any change in the Common Stock, Retained Earnings, or Cash Dividends accounts affects total stockholders’ equity.

statement of changes in stockholders equity

— Злобова Бронислава (@ibadadih) December 21, 2014

For example, they can be used to purchase new equipment, to invest in research and development, or to pay down costly debt. Preferred stockholders are held in a higher esteem than common stockholders when it comes to dividends and the distribution of assets. Retained earnings is the amount of money left in the business after the shareholders are paid dividends.